Sometimes you have to risk or lose money in order to make money. Other times it comes down to saving and positioning your money correctly. To me this is about having the right checking and savings accounts.

Aspiration is a company that has a social element. It makes them somewhat unique. They have a model where they allow their customers to simply pay what they believe is fair in terms of fees.

They also have a commitment to donate ten cents of every dollar of their revenue to charitable activities focused on helping struggling American build a better life for themselves. They let you choose a mutual fund of non-profits to donate to and your contribution is 100% tax-deductible.

They offer three products.

- Investment Fund: Redwood Fund – “A fund with the goal of investing in companies whose sustainable, environmental, and employee practices result in their being poised for growth.”

- Mutual Fund: Flagship Fund – “A mutual fund with a $500 minimum investment that has the goal of long-term growth with less volatility than the stock market.”

- High-Yield Checking Account – “A high-yield checking account offering 1.00% APY, no monthly service fees, and free access to any ATM in the world. With debit card.

If you are interested int sustainable companies and a volatile stock market, then check out their other two products. I’m more interested in their high-yield checking.

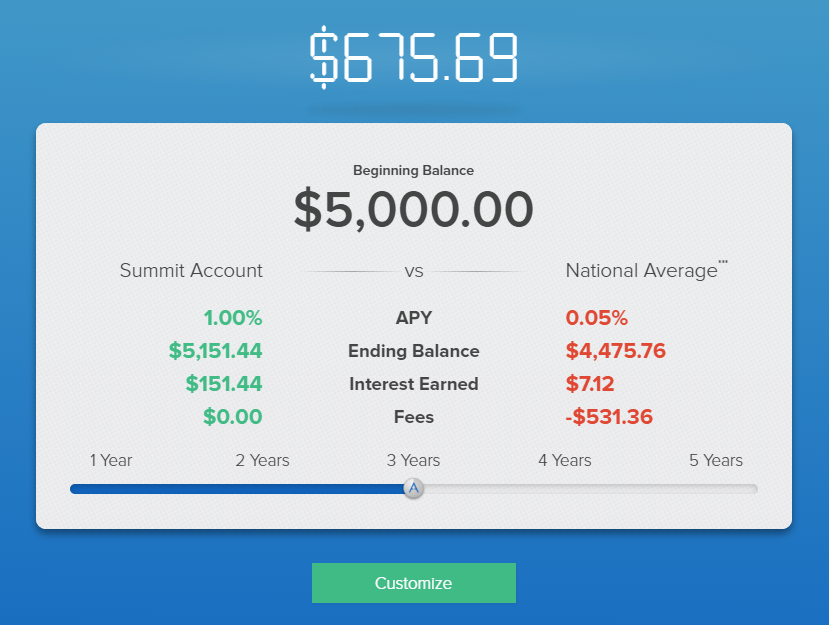

Traditional checking accounts notoriously have low interest rates and fees attached to them. Aspiration provides a nifty tool so you can see this.

1.00% is higher than you’ll find almost anywhere for a checking account. There are some high-yield savings. It also comes no ATM fees, no monthly maintenance fee, and only $10 minimum to open.

The only catch is that to hit that 1.00% you have to maintain a daily balance of $2,500 or more. If not, the interest is .25%.

So, if you are reviewing your checking account’s interest rate and it’s subpar, this might be for you. I would recommend you make your initial deposit more than $2,500 because for the first three weeks after you open the account they have some limits on how much you can withdraw and transfer. Transfers are free but their limits are the following:

- Initial Deposit – No limit

- First Week – $100 per day

- Three Weeks – $500 per day

- After 30 days – $5,000 per day external limit, $500 cash limit, and $500 PIN limit

Leave a comment