Everyone has tips and tricks that they like to use to help them save and to pay down debt. But is the number one rule? What is the rule that everyone should follow that will allow them to do just that?

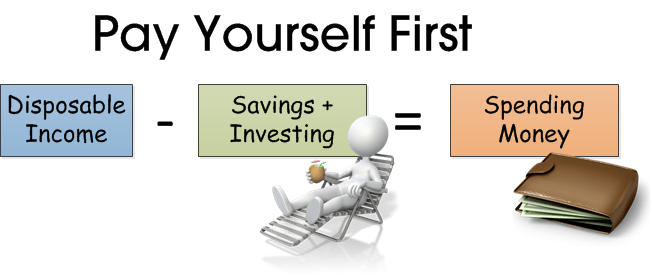

The number one rule is simple. It is pay yourself first. You probably heard this rule before or read it somewhere, and it simply put the first and the best rule for meeting your financial goals.

Paying yourself first works by taking whatever income you receive and diverting it to your savings or paying down debt before you do anything else with your money. You can set this up to be automatically withdrawn from your account or you can do it manually. I prefer to do it manually, yes I know I’m a control freak. The only thing you really have to decide is how much you should pay yourself first and how you want to pay yourself first.

You can use me as an example. I pay myself first in two ways and I typically do so in two ways. First, I divert a portion of my income to my savings. The other way I pay myself is by paying off a loan that I have. Now, the actual amounts may vary based on how frugal I have been during that time frame but I’m always paying myself first.

If you make this a routine, you will see your savings and your debt go down. You will also condition yourself to be more frugal because you have less discretionary income available to you.

So try it out. Pay yourself first.

Leave a comment